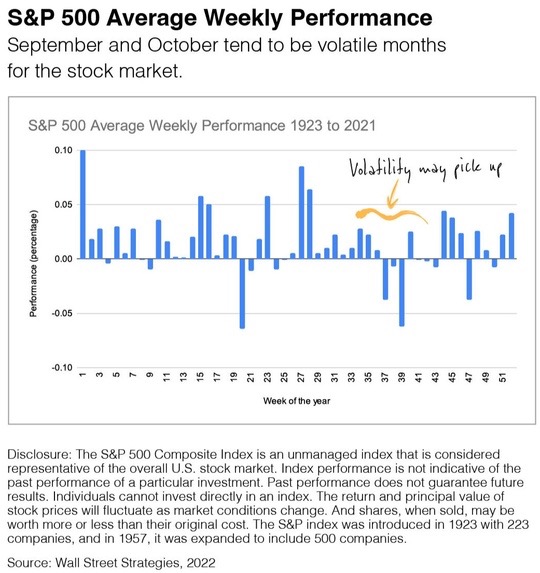

These Months are More Volatile Than Others

We’re entering a tricky time of year: September and October have a reputation for bringing an extra measure of market volatility.

Some of the stock market’s most challenging events have hit in September and October, and other seasonal trends can also play a part. Investopedia found that institutions start preparing for year-end distributions around this time. Plus, individuals tend to reposition their portfolios after the summer months.

This chart shows the average weekly S&P 500 performance since 1923. I’ve highlighted September and October so you can see how they compare to the rest of the year.

So what’s an investor to do? Just be prepared to roll with an uptick in volatility, and don’t let seasonal trading influence your overall strategy.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite.

Dr. Jason Van Duyn

Dr. Jason Van Duyn

586-731-6020

AQuest Wealth Strategies

President

![]() Dr. Jason Van Duyn CFP®, ChFC, CLU, MBA is a Registered Representative with and Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC. The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: IN, IL, TX, MI, NC, AZ, VA, FL, OH and CO.

Dr. Jason Van Duyn CFP®, ChFC, CLU, MBA is a Registered Representative with and Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC. The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: IN, IL, TX, MI, NC, AZ, VA, FL, OH and CO.