Outlook 2023: What’s Next for Interest Rates

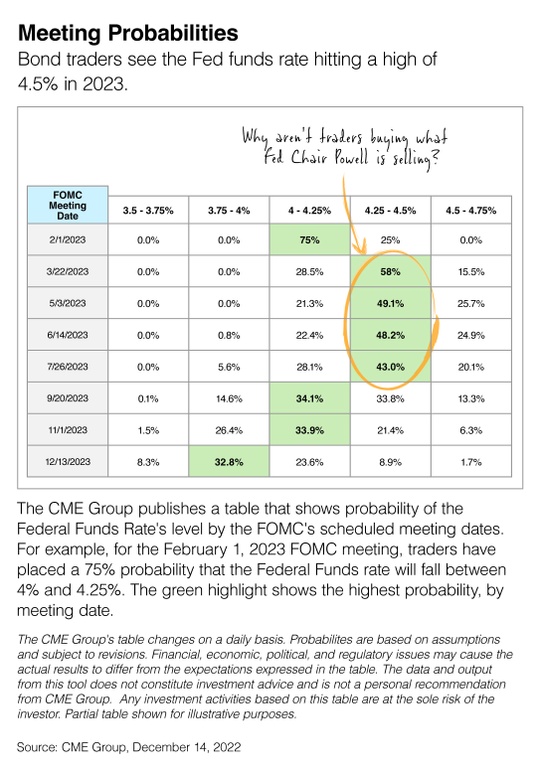

What does the bond market know that the Fed isn’t telling us?

Fed officials recently have said that short-term rates will need to climb to over 5 percent to bring inflation under control. But in the table below, you can see that the bond traders say short-term rates will top out at 4.5 percent in 2023 and then head lower.

The bond market is more dovish than the Fed. And perhaps with good reason. The November Consumer Price Index report came in below expectations, and there are more and more signs that inflation has started to trend lower, which may suggest the Fed’s work is coming to an end.

So why is the Fed talking so tough? As many of you may recall, Fed Chair Jerome Powell said inflation was “transitory” throughout much of 2021. The Fed Chair doesn’t want to mischaracterize inflation again.

I work with other financial professionals who listen to comments from Fed officials and compare them to what the bond market is saying. So if you happen to hear commentary about the Fed that’s unsettling in any way, please let me know as soon as possible so we can review what’s going on.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite.

Dr. Jason Van Duyn

Dr. Jason Van Duyn

586-731-6020

AQuest Wealth Strategies

President

![]() Dr. Jason Van Duyn CFP®, ChFC, CLU, MBA is a Registered Representative with and Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC. The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: IN, IL, TX, MI, NC, AZ, VA, FL, OH and CO.

Dr. Jason Van Duyn CFP®, ChFC, CLU, MBA is a Registered Representative with and Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC. The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: IN, IL, TX, MI, NC, AZ, VA, FL, OH and CO.