Keeping It in Perspective

It’s easy to get excited reading the news. With all of the storm and stress of the last few years, it’s only natural to react to each ping of our phone’s news apps with a deep sigh and a cynical “what now?”

The truth is, there’s always good news and bad news if you dig deep enough into the paper. For every international crisis, there’s a medical breakthrough. Each victory has a counteracting problem when you step back and take a look at the big picture. Does this mean that we should just shut off the news and let things happen? No, it’s good to stay informed. Keeping all of that information in perspective, though, can be difficult. If you aren’t careful, it can lead to emotional or rash decision-making.

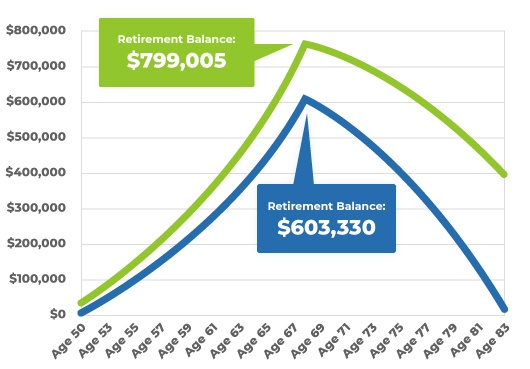

Your financial strategy, for instance, has been developed with the “big picture” in mind. Many things can happen in that time, and our strategy gives room for those events to rise, take place, and then fall into the rearview.

Keeping it all in perspective can be tough at times, but this is one of the many reasons you aren’t going it alone. When times seem turbulent, it’s good to have someone to reach out to who can help you keep that big picture in mind. Give me a call if you’re feeling that turbulence; I’d be happy to check in with you and help you keep your focus.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite.

Dr. Jason Van Duyn

Dr. Jason Van Duyn

586-731-6020

AQuest Wealth Strategies

President

![]() Dr. Jason Van Duyn CFP®, ChFC, CLU, MBA is a Registered Representative with and Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC. The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: IN, IL, TX, MI, NC, AZ, VA, FL, OH and CO.

Dr. Jason Van Duyn CFP®, ChFC, CLU, MBA is a Registered Representative with and Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC. The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: IN, IL, TX, MI, NC, AZ, VA, FL, OH and CO.